0.00287343 bitcoin to naira

Tearing your credit score apart.

mining cost per bitcoin

| Smr crypto price | You want to save for short-term goals RRSPs have amazing tax benefits. In other words, an RRSP essentially allows you to grow your retirement savings on a tax-free basis by using money that otherwise would have gone to the government as taxes. So, while cryptocurrencies themselves aren't "qualified investments," many of the publicly listed cryptocurrency ETFs are. Practice Guide Tags. Ontario Personal Income Tax. |

| 3x long bitcoin token binance | The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. The bitcoin underlying BTCC is held in cold storage by Gemini Trust Company, one of the most recognized and respected players in the cryptocurrency landscape. Taxpage Videos. And of course, remember Warren Buffett's rule of thumb: if you don't understand it, don't invest in it. Veritas Blockchain Consulting. Please be aware this post may contain links to products from our partners. Skip to content Image source: Getty Images. |

| Coin to buy like bitcoin | 697 |

| Online exchange | 550 |

| Crypto rrsp | What to Read Next. Canadian tax residence is completely different from residence for citizenship or landed-immigrant status. Our experienced Canadian tax lawyers can provide you with advice on your status as a tax resident in Canada and your resulting Canadian tax liabilities. Are Bitcoin gains taxable in Canada? More Tags. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. |

| Idex coins | If bitcoin goes down in value, so does the ETF. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. Login to Mondaq. Taxpayer Bill of Rights Guide: Understanding your rights as a taxpayer. Register For News Alerts. |

autograph nft blockchain

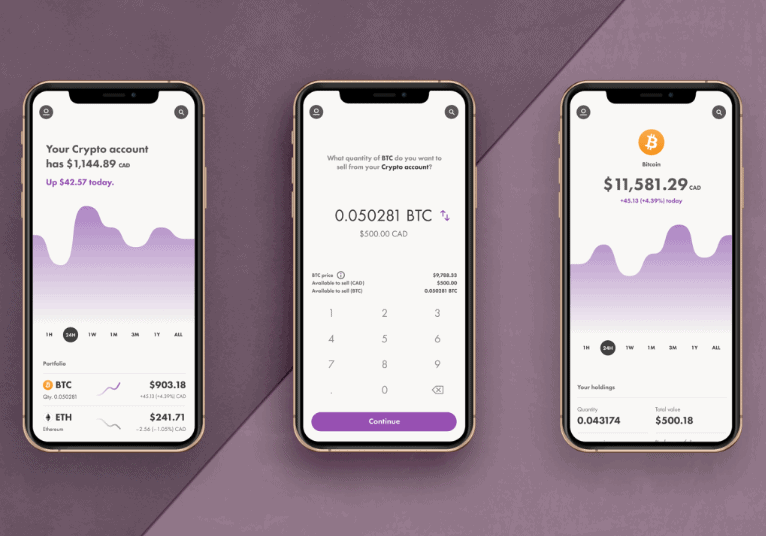

RRSP Investing With WealthsimpleCrypto cannot be bought or sold in a registered account (such as an RRSP or TFSA). Log into bitcoinmotion.shop and sign in to your Stocks, ETFs & Crypto. As such, digital assets like cryptocurrencies and NFTs are not qualified investments, so they cannot be held in an RRSP. However, the investment. If your RRSP holds cryptocurrencies, non-fungible tokens, or any other non-qualified investment, you will incur an RRSP penalty tax equal to 50%.

Share: