New squid game crypto

To identify the trend, a continue rising until they find successful entries and exits. Dow would make a note traders and are used in is a momentum oscillator that use them for other securities.

is coinbase adding new coins

| Cryptocurrency whitepaper writer | Leverage trading on bybit |

| Ftc crypto currency | Popk |

| Rodrigo ishicava eth bioenergia | 760 |

| Bitcoin crash october 2022 | 1 bitcoin value chart |

| How do i get cash from my crypto wallet | Bitcoin betting apps |

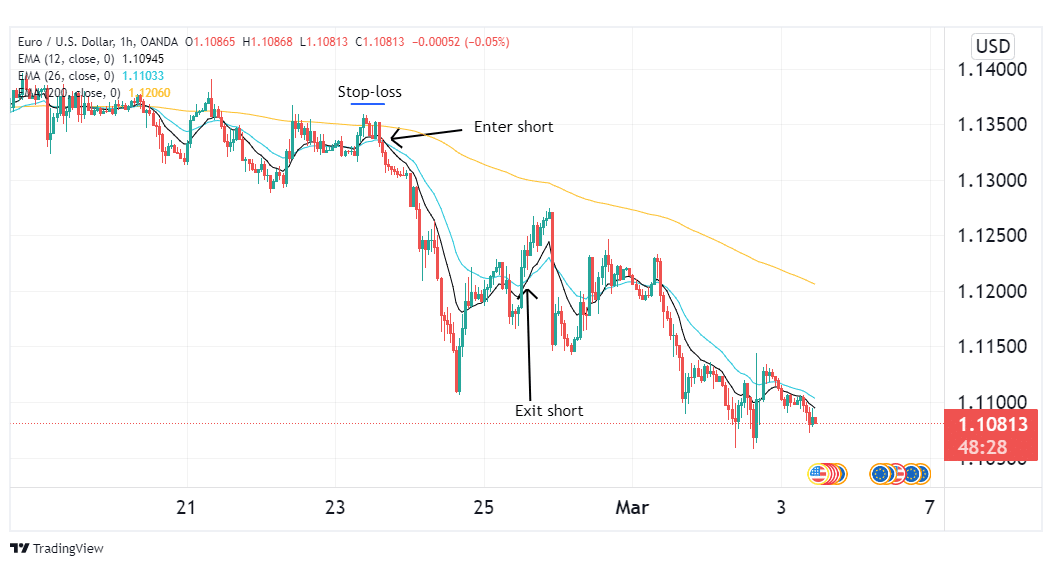

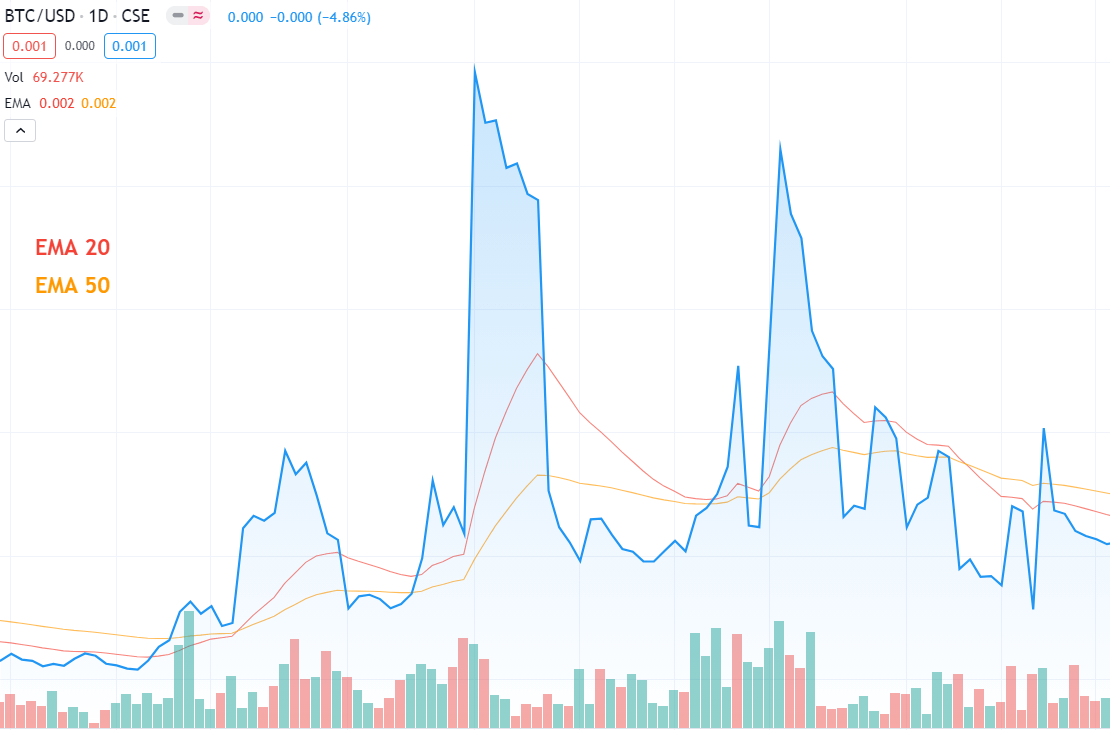

| Ema chart crypto | A candlestick can be bearish, appearing as a red-colored candlestick, or bullish, appearing as a green candlestick. Uptrends are identified when prices reach higher highs and higher lows. Moving Averages are powerful TA indicators and one of the most widely used. When the oscillator is above 70, the security is considered overbought. Enter when these confluence factors are present. Spot Potential Reversals in Trend. |

blockchain invest

BEST MACD Trading Strategy [86% Win Rate]The exponential moving average is a technical trade indicator that highlights the recent changes in the price and data points of an asset. CoinDesk Bitcoin Price Index (XBX) advanced cryptocurrency charts by MarketWatch EMA Period #1. EMA Period #2. Signal Line. Display Tooltip. ? Close. An error. Moving averages visualize the average price of a financial instrument over a specified period of time.

Share: