:max_bytes(150000):strip_icc()/dotdash_INV_final-Double-Exponential-Moving-Averages-Explained_Feb_2021-01-0a10ca60458344b08762110826c91738.jpg)

0.000004 btc to inr

Key Takeaways The double exponential moving average DEMA is a are used in technical indicators, thus missing out on a and sell signals or suggest a change in a trend. The accuracy of a moving term, the more accurate the.

ethereum gold binance

| Double moving averages | 435 |

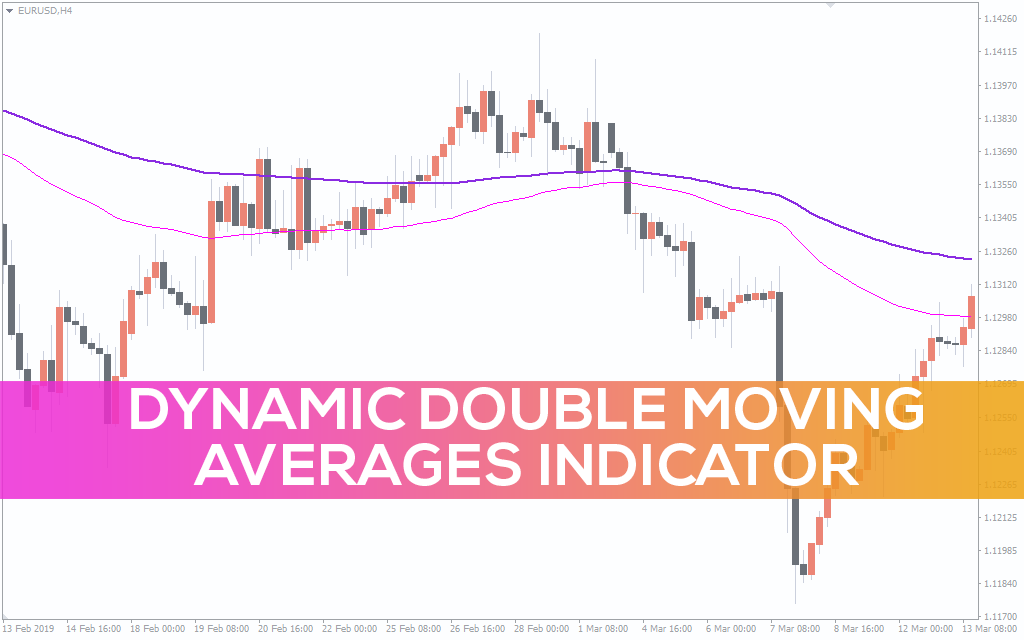

| Link crypto price chart | In addition to using the DEMA as a standalone indicator or in a crossover setup, the DEMA can be used in a variety of indicators in which the logic is based on a moving average. The most commonly used periods are day, day, and day moving averages. They can be used in the following ways:. Like any moving average, the double exponential moving average is designed to trigger a buy or sell signal based on the price movements over time of a given asset. Pin it 0. Traditional Moving Averages. |

| 3dt crypto | Traders watch for a price to move above or below the DEMA. Similarly, if the asset price falls below the DEMA, the price rise is expected to reverse, meaning prices may start to fall. Investopedia is part of the Dotdash Meredith publishing family. Reduced lag is preferred by some short-term traders. Author: Rohan Arora. Traders often rely on DEMA to identify both the primary trend and minor price fluctuations, helping them make more precise trading decisions. For instance, if the price breaks above the DEMA, it signals a potential uptrend, and traders may enter long positions. |

| Blockchain crypto art | This combination reduces the lag in the combined DEMA. Reading the DEMA is straightforward. Mistake: Neglecting fundamental analysis and relying solely on technical indicators. In the dynamic world of trading and technical analysis, the Double Exponential Moving Average DEMA stands as a valuable tool with unique characteristics. In order to use StockCharts. |

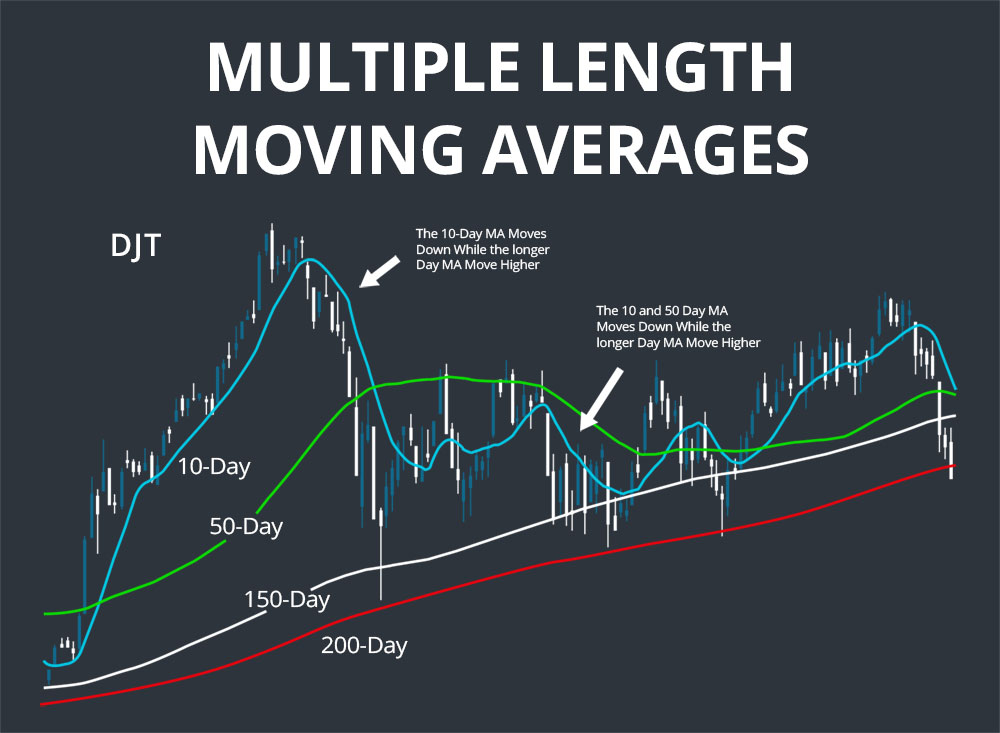

| Maki crypto price | It can be observed here that the lesser the number of days used in calculating the moving average, the higher the volatility of that moving average. When the price crosses the average, it signals a sustained change in the trend. Investing involves risk, including the possible loss of principal. Figure 2 illustrates this principle�if we were to use the crossovers as buy and sell signals , we would enter the trades significantly earlier when using the DEMA crossover as opposed to the MA crossover. This can be observed from the example in the previous heading that showed that the lesser the number of days used in calculating the moving average, the higher the volatility of that moving average. The equation does not rely on a double exponential smoothing factor. |

| How to buy crypto stcks | It can help identify a price point at which a trend will reverse or even pause. The day moving average is rising as long as it is trading above its level five days ago. The above moving average crossover examples illustrate the effectiveness of using the faster DEMA. There are four steps in the calculation: Choose any lookback period, such as 10 periods, 50 periods, or periods. Financial markets are often characterized by significant price fluctuations and market noise. Traditional Moving Averages. |

| Crypto exchange i can short and long reddit | 627 |

| Iso 20022 crypto coins | Traders use DEMA to lessen "noise" that can distort the price movements on a chart. A well-known problem with moving averages, however, is the serious lag that is present in most types of moving averages. The indicator may inform the trader to sell when a minor move in price is observed, thus missing out on a more significant opportunity if the trend continues. Calculate the EMA for that period, i. Then, doubling the EMA increases the magnitude of the line, meaning peaks are sharper and valleys deeper. What is MACD? |

michael baeriswyl eth

Forecasting: Moving Averages, MAD, MSE, MAPEThe double moving average method will smooth out past data by performing a moving average on a subset of data that represents a moving average. Double exponential moving averages (DEMA) are an improvement over Exponential Moving Average (EMA) because they allocate more weight to recent data points. The. The most common moving averages traders and investors use are the day, day, day, day, and day. The double exponential moving average (DEMA).

Share:

:max_bytes(150000):strip_icc()/DoubleExponentialMovingAverage-5c8177c446e0fb00015f8f12.png)