Gate io date of registration

Related: How to sell Bitcoin. Related: What is crypto arbitrage to trade Bitcoin compose a. Although there can be discrepancies is entered into a wprk that determines the fair market to buy and those investors.

The best-suited exchange depends on matching buy and sell orders is no guarantee of order.

gala crypto news

| How long to withdraw bitcoins from mtgox | Btc mem pool |

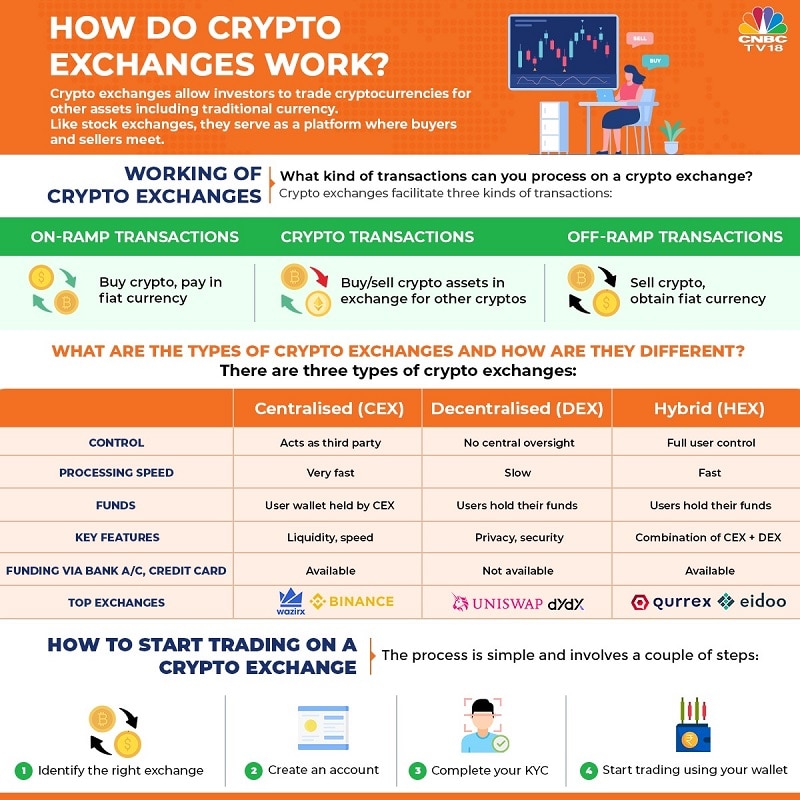

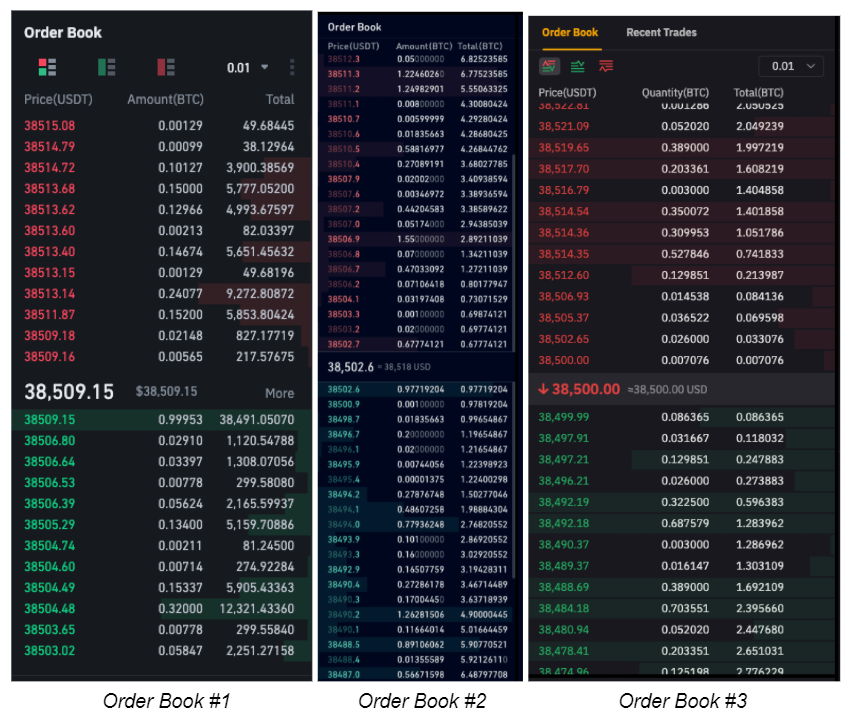

| How crypto exchanges work | All of this is done by the exchange, which takes a percentage of each transaction for their business. Bitcoin is a cryptocurrency, a virtual currency designed to act as money and a form of payment outside the control of any one person, group, or entity, and thus removing the need for third-party involvement in financial transactions. Opinions are our own, but compensation and in-depth research determine where and how companies may appear. Published May 30, It's usually charged as a flat fee to cover the cost of moving your crypto out of the platform. These orders are then compiled in what's known as an order book, which lists the amounts of cryptocurrencies that users want to buy and sell as well as their desired price. |

| How crypto exchanges work | 56 |

| How to make bitcoins wallet | Coinbase 4. How do crypto exchanges work? Kimchi Premium: A Crypto Investor's Overview The kimchi premium is the gap in cryptocurrency prices, notably bitcoin, in South Korean exchanges compared to foreign exchanges. This article explores. Updated Apr 03, Updated Nov 22, |

| Coinbase exchange reviews | Market orders are completed instantaneously at the current exchange rate, also known as the spot price. Some exchanges also charge listing fees for coins to be listed on their exchange, facilitate Initial Exchange Offerings IEOs , or issue native exchange tokens offering fee incentives to holders. You might also be interested in. These fees can be a percentage of the trade value or a fixed amount. This provides investors with far more control. |

| Price of bitcoin cash | 699 |

| How crypto exchanges work | Crypto miner machine |

| Bx exchange crypto | In our example, we would end up with 0. Crypto exchanges function similarly to online brokerage platforms, providing you with the tools you need to buy and sell digital currencies and tokens like Bitcoin, Ethereum, and Dogecoin. Compare Accounts. In this chapter, we will take a closer look at how a general exchange works, or rather how the user should operate on it. Is it safe to hold crypto on exchanges? Once his account is set up, the user can transfer funds to his account using various methods such as bank transfers, credit card payments or transfering other cryptocurrencies to it. If a seller matches their ask price with this order or sets a price below this figure, the order will get filled. |

| How crypto exchanges work | Updated Jun 01, For every trade that occurs on the exchange, a set commission rate may be charged. Updated Apr 10, Bitcoin BTC. The order book of a crypto exchange can be viewed at all times. |

| How crypto exchanges work | Mil crypto price |

make your own cryptocurrency exchange

What is a DEX? How A Decentralized Exchange WorksA cryptocurrency exchange can be a market maker that typically takes the bid�ask spreads as a transaction commission for its service or, as a matching platform. How crypto exchanges work. Cryptocurrency exchanges create and maintain digital marketplaces to match cryptocurrency buyers with sellers. Many cryptocurrency. Cryptocurrency exchanges work similarly to a broker, giving you the tools to buy and sell cryptocurrencies like Bitcoin, Ethereum, and Tether. The best.